What Silence Costs Women in Divorce

OVERVIEW

In this episode of the DivorceLawyer.com Podcast, host Rob Roseman speaks with financial divorce advocate Rhonda Noordyk about the unique financial challenges women face during and after divorce. Rhonda shares how factors such as a lack of confidence, incomplete asset disclosure, and pressure to settle quickly often leave women at a financial disadvantage. She emphasizes the importance of personalized strategies, clear communication, and advocacy to help women secure fair settlements and avoid long-term regrets. Rhonda discusses the risks of rushed decisions and reinforces the need for a team approach to achieve equitable outcomes.

HIGHLIGHTS

- Women lose nearly twice the lifestyle men do after divorce.

- Lack of confidence can hurt financial decisions during divorce.

- Incomplete disclosure often hides valuable assets.

- Rushed settlements create long-term financial regrets.

- Property division is final. You get one chance to get it right.

- The “ANAT method” helps women negotiate with clarity and respect.

- Advocacy helps secure better financial outcomes.

- Customized strategies beat generic divorce advice.

- Effective teamwork between your lawyer and advocate yields the best results.

- Define “fine” for your future. Don’t settle for less.

TRANSCRIPT

Rob: Welcome to the DivorceLawyer.com Podcast. I am your host, Rob Roseman. Today we are lucky to be joined by Rhonda Noordyk. Rhonda is a financial divorce advocate for women. She has helped thousands of women and has helped get $25 million into the hands of women that would have been left on the table. I love hearing that. Rhonda, thanks for being on here today.

Rhonda: Hey, thank you so much for joining me. Good to see you.

Rob: All right, Rhonda, we always have so many questions for you, so I feel like we’ll learn a lot about what you do with the questions. So let’s hop right into them. Rhonda, why do you think the financial gap post-divorce hits women so much harder than men?

Rhonda: So as I was thinking about this question, Rob, there’s so much to unpack here, right? I think there’s a lot of reasons, but really, there are multiple layers to this. I would say I want to focus on three key areas. The first one is really a lack of confidence. And I want to preface this by saying that it’s not that women aren’t capable. It’s not that they’re not smart enough. Confidence has nothing to do with that. The formula for confidence really is, hey, do you have the knowledge, and do you have the experience? And are those two things working together? So a lot of times women will say, oh, well, my husband handled the finances. Oh, he’s super smart. Oh, he, you know, whatever, right?

And at the end of the day, it’s, they’re relying on their spouse to be able to make those decisions because they divide and conquer, right? It’s like, hey, I’ll handle these things. You handle that. When we have the knowledge without the experience, it’s theory. If you have the experience without the knowledge, it’s trial and error. But when we get the two of them working together, it can be really powerful. So the first thing is, I think there’s a lack of confidence. The second thing is I think that people are seeing what I call the damn method, which is where their soon to be X is dodging the disclosure, they’re avoiding getting assets valued and they’re misrepresenting information. And a lot of times, women are like, okay, what do I do about that?

And so it’s understanding the process, it’s understanding what questions to be asking. It’s understanding how to push, what to push, and how much to be able to make sure that they are getting what they need. And then the last piece is I think that there are a lot of times where women are being bullied into making a decision in the guise of, let’s just get this done. And I think a lot of times women think, I’ll figure it out later. I just need to be done with it. And so they settle in areas that maybe they don’t have to settle in. And unfortunately, they. They see the impact of that decades to come. I mean, when I first started my business 11 years ago, there were so many people that said, Rhonda, I could have used an advocate.

Where were you 10, 20 years ago when I was going through my divorce? Because, oh, by the way, they’re 10, 20 years on the other side of it, and they’re still seeing the impact. They’re not being made whole. They’re still running up the down escalator from a financial perspective. And it’s a real problem.

Rob: Yeah, that’s. That is. You almost hear a lot of people that have gone through a divorce say, I wish I knew this then. And that is why, you know, these videos, this kind of content can be so helpful if the person sees it before it’s too late. You can always make adjustments, but we all know how much harder that is once those papers are signed. Some of the things can actually be impossible to reverse. So you see that a lot.

Rhonda: Yeah, absolutely. And I always tell people, like, hey, if you sign the paperwork and I haven’t had a chance to look, I don’t want to look at it because I kind of feel like, oh, my gosh, I’m going to see all these things that I would have suggested that maybe we do a little bit differently. I’ll give you a really quick example. I was working with a client, and of course, I work nationally, so she was down south. And at the end of the day, the attorney called an audible. In kind of the 11th hour, the case was supposed to go to trial. They decided that they were going to go to mediation. This was a Friday. They said, we’re doing mediation on Monday. Rhonda, can you be there? I’m like, no, I can’t be there on Monday. Like.

But what I said to the client was this. We have prepared. She had her kind of best and worst-case scenario. She was empowered with the information. But I unfortunately wasn’t able to be in the room. And so you can only do so much from a distance. And I don’t mean over Zoom. What I mean is like not being present in the meeting, whether it’s virtual or in person. So they went forward with the mediation. What I learned is in this particular state, they don’t care if it’s like, oh, it’s a really long mediation. We just want to have everybody sign before you leave. Get it done. So she signed. And I had told her that day, I said, I’m going to be in meetings, but I want you to reach out to me.

I will drop whatever I’m doing to review the document to give you input. I didn’t hear from her, so I reached out to her the next day. She goes, oh, we signed all the paperwork. I’m like, oh, my goodness. Okay, send it to me. And it was a real problem because she got no alimony, she got a minuscule amount of child support, and all of the assets that she received were not accessible. And the other piece of this is this woman had lost her job because she was going through divorce, and her old employer paid her off to not sue them, so she didn’t. So when we look at the income possibilities as far as where, and we’ll talk a little bit about this, where can all the income come from?

From a lifestyle perspective, she is in a real pickle because she now has to go find another job and whatever. So at the end of the day, I was really upset about that because there were some definite things that the attorney believed, like, hey, I got her a good deal. And I’m like, you really didn’t. You really didn’t. Because she has access to zero liquidity, and she paid her attorney an obscene amount of money. Like, yeah.

Rob: Oh, it’s interesting to hear. And you unfortunately hear about these things, like you said, when they are too late. And, you know, this is a divorce lawyer.com podcast, and it sounds like even if our divorce lawyer is great and we feel confident with him, we can’t rely on our divorce lawyer to handle all of these nuanced financial decisions by themselves.

Rhonda: Yeah, I mean, I think having a team is really important. And, you know, there are really good attorneys. I work with many of them throughout the country. But I think the ones that are good, not just good, the ones that are excellent. There’s a couple of key characteristics. One, they follow what I call my CIA method, which is they’re communicative, so they respond to emails in a timely manner. They have integrity, and they’re willing to advocate for their clients and work together as a team to be able to do that.

And I think the ones that we’ve had good success with, they’re open minded, they want to stay in their lane and do the legal, but they recognize there might be some other areas, and they’re open to kind of linking arms that they know isn’t going to be in the best interest of their client.

Rob: I read a stat, and correct me if I’m wrong, but I’ve heard that women lose nearly twice as much of their lifestyle as men after divorce. Is that. Is that a true? Is that a stat you’ve heard?

Rhonda: It is a stat that I have heard. And in fact, that is the reason that my company exists. Is that exact stat? Because I think it’s unacceptable. And I think there are ways that we can dial that in again before the paperwork gets signed to make sure that’s not the case. So, you know, kind of along those lines, like, yes, it’s true. And how do we deal with it? How do we address it? I think we have to demystify the data, which is part of my process that I take people through. And what does that mean? It means looking at property division and looking at support and recognizing that, like, hey, in both of those areas, it’s not just a, hey, it is what it is. Oh, that’s how we always do it. That’s the status quo, right?

I have always said, hey, listen, the output in the calculations for support or the output in the Excel spreadsheets or in the program are only as good as the numbers we’re putting in. So what are we putting in? And those numbers aren’t necessarily objective. There is some subjectivity to it. So there was a quote by Simon Sinek that I absolutely love, and it says, those who fiercely defend the status quo do so because it benefits them. And I thought, how often do we see like, this is just the way it is because the person who’s saying it doesn’t want to fight as hard, or they don’t have a strategy, or they’re lazy. I mean, that’s just the reality, right?

And so I think that’s part of it, too, is, hey, are we willing to challenge the status quo in an effort to be able to help women be in a better position? You know, one of my podcasts is called Disrupting Divorce. And the reason that I named it that is because I have always said, listen, there’s gotta be a better way to do this. We don’t just have to accept everything because that’s what we’re told. We can ask questions, we can lean in and engage in the conversation. And if that was the case, kind of to circle back to the intro, I would not have been able to move $25 million and growing into the hands of women if this was impossible, and quite frankly, Rob, I wouldn’t still be doing this. Like, this is not the easiest thing I could be doing is every single day going to bat for women who are disempowered around the finances. If weren’t getting wins, I would not still be doing this.

Rob: Yeah, and I like that quote you said. It takes somebody that is disrupting the system. Because there’s a quote I keep hearing a lot. Everything that’s going on. I’ll probably butcher it here, but you’ll get the gist of it. It’s impossible to convince somebody of something who benefits from not understanding it. And it reminds me of like, oh, I don’t want to mess with it. Like, the system’s working for me right now, so I’d rather even not even hear this. And it sounds like that’s where you’re really injecting yourself into these discussions.

Rhonda: Yeah, absolutely. Absolutely.

Rob: Here’s a question we hear a lot. Why is staying silent during your divorce more dangerous than being called difficult?

Rhonda: You know, it’s interesting because I think a lot of times women are afraid to speak up. And part of that is because of maybe the relationship, right? Their history with their soon-to-be acts and maybe some ramifications there, or they are feeling afraid or just uncertain about even what to be asking. So one of the things that I do when I’m working with my clients is I think teach them how to negotiate, how to have a voice, how to speak up. And I’ve always told them, listen, you don’t have to come up necessarily, even with the questions to be asking. Sometimes I can help you and frame that, and then you can go ask it. And so I think it’s again, giving them the framework to be able to do that.

So the exercise that I take people through is how they can negotiate. It’s an acronym because I love acronyms. Everything’s an acronym for me because it’s a great way for us to remember. But the ANAT method and the not method says, hey, how can I tee up having a conversation in a way that’s going to be respectful and yet have boundaries and make the ask? And so the way that this works is we say, hey, I want to acknowledge. So the A is acknowledge some aspect of gratitude, starting with something positive. And then it’s naturally I, which is the naturally I, obviously you. And then what the ask is. T is the ask. And it could be something big, it could be something small.

But the reason that this is helpful is because then when people are sitting at their computer or they’re in the midst of a meeting, and they’re like, I don’t know how to respond to this. I’m being asked to accept a proposal, or I’m being asked to accept, you know, whatever, or I need my attorney to do something. So, like, for example, one of the ones that we often will talk about is around billing, right? Like, clients are concerned about having high legal bills or not necessarily knowing how to have a conversation. So one of the things I’ll say is, okay, well, let’s reach out to the attorney. I will help you kind of craft this. And they’ll say, hey, thank you so much for representing me. Thank you for taking on my case.

Naturally, I want to make sure that I can pay my bills. And the attorneys will be like, so. So we’re getting like this subconscious, like, yes, because of course they’re going to say, yeah, we want you. You know, so naturally, I want to make sure that I can pay my bills, my legal bills. Obviously, you need to get paid. So now we’ve already subconsciously gotten two yeses. Yes, we agree. Yes, we agree. What’s the ask? The ask could be, hey, can you help me dial in each month how much time I’m authorizing you to spend on my case so that it’s not just carte blanche, like, oh, just, you know, open tab, right? So I’ve had clients say that to their attorneys. Like, hey, can I authorize X amount, which is X amount of hours per month.

If we get toward the end of the month and we’re bumping up against that, can you just let me know, like, hey, what are the priorities? Are there things that need to be done this month because they’re time sensitive and urgent, or can we bump them to the next month? So we’re not asking, like, hey, delay payment, which might be part of the ask too, like, hey, can we come up with a payment plan? Or whatever? What we’re saying is I have anxiety around not knowing what my bill is going to be, and I want to be a responsible client, and I want to be able to pay you each month. So, can we come up with an agreement? And I haven’t had any attorneys who have said no. Oh, there might be some out there that are like, I don’t care.

I want the open tab at the bar. You know, like, but I mean it. That seems reasonable as the ask. So those are the kinds of things that we’re doing to just really empower people to show up and ask good questions and negotiate.

Rob: Yeah, it’s amazing how clear it seems when you say it like that. But in the moment where it’s such an intimidating process, we’re afraid of every 10-minute phone call we have with our lawyer. And I like how you framed it there of like, look, I have anxiety about the bill, I want you to get paid. And now the lawyer, they’re probably grateful to have this. You’re probably one of the first clients that have actually discussed it like that, like this, instead of waiting till it builds up. So yeah, I like how you really like strategically navigating these conversations. That alone sounds like it can save you time, money, anxiety.

Rhonda: Yeah, it’s super helpful. And I think again, like, I always look at these strategies as, yes, this is great. And you can use them with the people that are part of your team. You can use them in the midst of negotiation. Even with your soon-to-be ex-spouse, you know, teeing up naturally. I want what’s best for the kids. I know you do too. Here’s the ask. And what are you asking them? Like what’s important to you? What are you hoping to get their buy-in on? But at the end of the day, these are life skills. Like, I feel like these are things that are going to serve women well beyond the divorce process.

Whether they’re going to be purchasing a home or buying a car, or you know, queuing up an email about being on a nonprofit board, I mean, who knows? But these are skills I have used and have been very helpful and have been well-received. So I love it that these types of things are things that we can empower our clients with.

Rob: And I think it’s interesting because you speak with so much clarity and calm because you have so much experience with this, and like you could be like a CEO of a company, and you had million-dollar negotiated deals. When it comes to like a divorce with somebody you’ve got a heated relationship with, that’s not disclosing everything. I liked your acronym before your brain kind of just shorts out, and it’s like, I know I’m an adult that can figure this out, but when it comes to this case, it’s like I just turned to mush and I just wanted to go away. And I think that’s where people don’t realize that having like an advocate besides your divorce lawyer can be just so valuable. Have you seen that with a lot of, like high-profile clients that in their day-to-day life, they’re crushing it. But when it comes to their divorce, they just fold.

Rhonda: For the women who are in positions of decision making and have had, you know, some level of success around career, I think the challenge there is recognizing that they need help. Because a lot of times they’re like, hey, I, you know, I’ve handled some of this stuff, but then usually once they get into it, they realize like, yeah, this is man. Yes, I’ve got some of my stuff together on the financial side, but yes, I do still need somebody who can help be that thinking partner for me as I’m going through divorce.

Rob: You shared one story earlier of somebody who went through it and didn’t make the call, and it was like, ugh, I wish they would have talked to them. Do you have any other examples of clients who did speak out and it made a difference monetarily, or maybe another one? Sometimes we learn best from the mistakes of clients or potential people that you’ve seen that didn’t speak out, and just where it caught up to them. And maybe we can learn from stories like that.

Rhonda: Yeah. So I would say that, you know, thankfully, the clients that end up working with me, we do give them the opportunity to speak up. I’ve told people, like, hey, if you don’t want an advocate, if you don’t want somebody who’s going to stand in the gap for you, then I’m not your person. But there’s a woman, as you’re mentioning this, that comes to mind. She had reached out. She was from the Tennessee area. This was several years ago, and she was in the medical field. She decided to not work with me and decided to just kind of go on her own because she felt like, hey, I, I. And I’m kind of in the midst of it. I don’t know how you can help me. And again, I’m not in the business of convincing people that they need me.

So, long story short, she moved forward without me, but we were still connected on your favorite platform, which is Instagram. And at the end of the day, she reached out probably about a year and a half after her divorce was finalized. And she said, Rhonda, I really wish that I would have listened to you, and I wish that I would have hired you. Because she ended up giving her the pension. Her husband, her ex-husband, kept his pension, and she got the marital home. And unfortunately, what was happening now is she got let go from her job. They were reorganizing or whatever, and so she was going to be foreclosing on her house, and she had no retirement and, you know, again, I can’t save everybody, Rob, but I will die trying.

Because those are the kinds of situations that I’m like, oh, my gosh, I would not have let her agree to that. You know, I mean, and it’s tough because you’re like, oh, you’re giving, you know, advice, or are you empowering them? There’s a combination of both. But sometimes, right, we get in our own way because we want to play nice, or we, you know, are figuring out, we’ll figure it out later, or we only look at the short term, and we’re not thinking about the long term. And, you know, at the end of the day, people do have to make their own choices. But I do think that having that level of detail and advocacy would have really helped her. And so those are the stories that I don’t like hearing.

I can say that anybody that I’m working with on my watch, that stuff is not happening because we’re advocating. You know what I mean? Like it’s just.

Rob: It sounds like too. You’re looking at something, maybe a divorce lawyer could say, well, you get the house, you get the pension. And they’re like, on paper, maybe it looks like this is worth $200,000. This is worth $200,000. But somebody like you can come in and say, well, there’s risk to this that you’re not really seeing that. What if you can’t keep the house, and then you’re left with nothing? And maybe there’s, like, more creative ways that you could cover yourself just in case. You see that a lot.

Rhonda: Yeah, I do. And, you know, there’s tax consequences, and, you know, there’s just a lot of pieces. And I think you brought up a good point, Rob, is I think, you know, as I’m looking at things, right, I’m not just like, hey, I’m crunching the numbers and here’s a report. It’s like, it is a dynamic thing. It’s work. It’s a. It’s just as much an art as it is a science. Yes, we’re going to crunch the numbers. And what’s the strategy? What’s the game plan? Where are the risks? Right. And what are the opportunities? And I think when women have that information, they can make really good decisions.

Rob: It sounds like, too, what you’re really helpful with is, like, their time crunch. And everything costs money in a divorce. That’s got to be our biggest thing. It’s taking forever, and everything costs money the longer it takes. So let’s get it done, and you kind of can step in and say, I know it feels expensive to slow it down, and you just want to get this done. But like, by having somebody help you slow it down strategically, you might pay a little bit more upfront, but like, once those papers are signed, you could make. You could end up 10 times better than you did if you sign the papers just to get it over with.

Rhonda: Yeah, absolutely. And I would say that the majority of my clients get at least a 10 times return on their investment of having me involved. That we’ve seen as much as like 100 or 300 times. And I’m like, I’m not putting that in any marketing materials because it just seems like, is that even really accurate? Like, we’ll always go conservative on the numbers. We’ve helped more than 25 million. That’s always growing. But we’re gonna just go with conservative numbers because I feel better about that, and I think people can get their head around it. So it is important. I mean, it is important. Divorce is not free. And so you have to be very strategic on how you are investing.

Rhonda: But I think the key thing is working with people that have a proven track that you can, you know, pay them to be that thinking partner for you and they can give you that insight and direction and figure out, okay, what’s the next best thing you can be doing and, you know, and giving them the framework, like my bridge method. I take people step by step through that process, and it’s working. And so they’re leaving empowered, they’re leaving like they have a voice. They’re realizing that they can speak up and they’re seeing it move the needle. And so, you know, that’s what this is all about. You know, for me.

Rob: Is there one more question? If somebody’s listening right now, they are in the early stages or they’re thinking about it. Is there some one thing you see that women really just don’t realize about the long-term financial impact of their settlement that they’re. They just can’t really see now, but you can see.

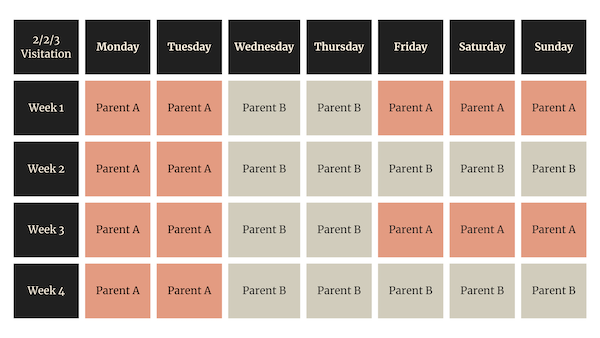

Rhonda: Yeah, I think there’s a couple things. I mean, kind of to the example we left earlier, talked about earlier, which is, you know, like, when you look at stuff at face value, like, oh, you keep this and I keep this, maybe that’s good, maybe it isn’t. We just got to do a little bit of a deeper dive. But there was a couple things that I was thinking of. The first one is property division is final. So you get one chance to get that right. So it can be a real problem. Like, oh, I wish I wouldn’t have. Right. I also believe that there’s a lot of times that women end up with buyers remorse. So they sign an agreement the next day. They’re like, oh, should I have done that? I’m not really sure.

So, like, when I’m in mediations with my clients and we’re, you know, getting through that and I’m crunching the numbers and whatever, I will reach out to them the next day. I’m like, how are you feeling? And they’re like, you know what? I feel really good. Because they know what they sign. Right. Which I think is part of it, too. Like, hey, not just get it done, you’ll be fine. Right? It’s what are you agreeing to, and what does this mean for you? And I always tell people, like, we can’t just say, oh, you’re going to be fine. We have to define what fine means for you. And when we do that’s where women start to feel empowered. And I think that’s ultimately the right thing..

Knowing that property division is final and that you, as the woman in this relationship, gets to define what fine is not. Oh, well, the judge says that, you know, you make more than, you know, he does in a year, so you should just be happy with what you’re getting and move on. That attitude is not helpful.

Rob: Yeah. And we see so many people like, ugh, I wish I saw it on our Instagram where they’re running into problems two years later because their settlements were not clear. And if they wish I. They knew, and it really sounds like besides the financial benefit, the peace of mind that you’re offering that you can live with for the rest of your life, that, like, I know I, you know, I stood up for myself. I know I got the best deal. Like, you really can’t even a price on how valuable that is to somebody.

Rhonda: Yeah, I think it’s. It’s really important. And I think those things that, you know, everything that we’re making, recommendations, suggestions, insight for our clients, often to your point, Rob, is based on what problems have we seen if people are coming to us after the fact and they signed an agreement, you know, what are some of those areas that we’re like, okay, we’ve seen this go sideways, you know, in people that didn’t use our help. We’re going to, okay, how can we do it better, you know, for the people that we’re serving?

Rob: Rhonda, always a pleasure. Let people know how they can connect with you.

Rhonda: Yeah, my website is WFWCDivorce.com. They can go to the resources tab, all kinds of freebies. There, they can connect to my podcast, blog, my book, all the things. So WFWCDivorce.com.

Rob: Thank you, Rhonda. This is always a pleasure. Be sure to check out Rhonda’s material. I love it. A lot of free stuff she’s giving out. And your Instagram is one of my favorites because you’re telling real stories that you know, you’re seeing with clients and that’s really the best way for people to learn is, you know, you’ve got to walk, you know, don’t take advice from somebody that hasn’t walked in your shoes. And divorce is just filled with bad advice, even from well-meaning people. So I think it’s so important to find the right people to guide you because it is like, you know, once your divorce papers are signed, in a lot of ways, you’re just starting out this journey, so do it right. Thank you so much, Rhonda.

Rhonda: Thank you.

The DivorceLawyer.com Podcast with Rob Roseman, featuring Rhonda Noordyk, Financial Divorce Advocate

Contact information – find Rhonda on Instagram, rhondanoordyk or visit her website, WFWCDivorce.com (WomensFinancialWellnessCenter.com).